Propsperity, This forwarded email from The Blog of Author Tim Ferriss provides some instructions and examples of folk who have made very profitable businesses and the process they utilized. Use in your business-life and work towards Improvement !

Seko ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ How to Create a Million-Dollar Business This Weekend (Examples: AppSumo, Mint, Chihuahuas) Posted: 24 Sep 2011 01:20 AM PDT

Noah Kagan built two multi-million dollar online businesses before turning 28. He also looks great in orange. (Photo: Laughing Squid)

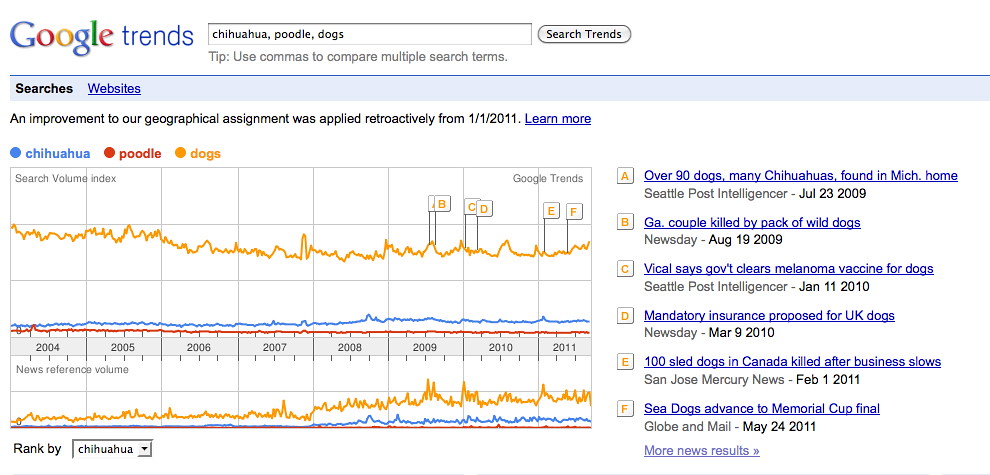

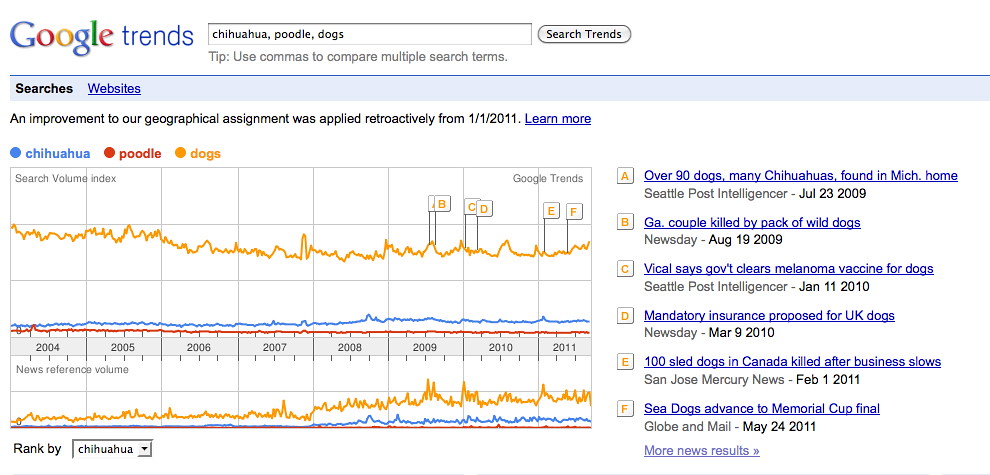

I first met Noah Kagan over rain and strong espressos at Red Rock Coffee in Mountain View, CA. It was 2007. We were both in hoodies, had a shared penchant for the F-bomb and burritos, all of which led to a caffeine-infused mindmeld. It would be the first of many. The matchmaker then introducing us was the prophetic and profane Dave McClure, General Partner of 500 Start-ups, which is now headquartered just down the street from Red Rock. Mr. Noah has quite the start-up resume. He was employee #30 at Facebook, #4 at Mint, had previously worked for Intel (where he frequently took naps under his desk), and had turned down a six-figure offer from Yahoo. Since we first met, Noah's helped create Gambit, an online gaming payment platform and a multi-million dollar business; and AppSumo, loved by entrepreneurs and moms everywhere. He also helped pour fire on both the 4-Hour Workweek and 4-Hour Body launches. The purpose of this post simple: to teach you how to get a $1,000,000 business idea off the ground in one weekend, full of specific tools and tricks that Noah has used himself. He will be your guide… Enter Noah For some reason, people love to make excuses about why they haven't created their dream business or even gotten started. This is the "wantrepreneur" epidemic, where people prevent themselves from ever actually doing the side-project they always talk about over beers. The truth of the matter is that you don't have to spend a lot of time building the foundation for a successful business. In most cases, it shouldn't take you more than a couple days. We made the original product for Gambit in a weekend. "WTF?!" Yes, a weekend. In just 48 hours, some friends and I created a simple product that grew to a $1,000,000+ business within a year. Same deal for AppSumo. We were able to build the core product in one weekend, using an outsourced team in Pakistan, for a grand total of $60. Don't get me wrong–I'm not opposed to you trying to build a world-changing product that requires months of fine-tuning. All I'm going to suggest is that you start with a much simpler essence of your product over the course of a weekend, rather than wasting time building something for weeks… only to discover no one wants it. I know what you're thinking: "Yes, Noah, you are SO amazing (and handsome), but what can I do this weekend to start my own success story?" Here are the steps you can take right now to get started on your million dollar company: Step 1: Find your (profitable) idea. At this stage, you are simply looking for something that people are willing to spend money on. So grab a seat and write down a list of ideas that you think might be profitable. If you're having trouble coming up with ideas, try using the methods below to speed the research process along: Think of all the things you do on a daily basis. Anything done more than once has potential for a product or service to improve the process. For me, one of those products was a mirror I could hang in the shower. It saves me tons of time while shaving, and now I don't know how I ever lived without it. Be cognizant of products you use and frequently complain about. Before Gambit, we were constantly asking our payment tool partners for certain features, yet our requests were always rejected. That was the impetus for us to create Gambit for our own games. Check completed listings on eBay. This allows you to see how well certain products are selling. It's also an easy way to measure sale prices of items and gauge the overall percentage of the market that's receiving bids (i.e. in demand). Look for frequent requests on Craigslist gigs. These listings are from people actively searching for someone to give their money to in exchange for particular services. Try searching for certain keywords (e.g. marketing, computers, health) and keep track of the total number of results displayed. Evaluate the most popular keywords and see if you can create a product or service around those requests. Browse the Q&A on LinkedIn. On average, LinkedIn users are worth $134, so there is a good chance they'll have money for you if you can provide solutions to their problems. Step 2: Find $1,000,000 worth of customers. Now that you've found an idea, it's time to assess whether there's a big enough pool of prospective buyers. In this step, you'll also want to ensure your market isn't shrinking, and that it fares well compared to similar markets. I use Google Trends, Google Insights, and Facebook ads when I'm in this part of the process. They're great tools that help me evaluate the growth potential of my target market. For example, let's say you decide to build information products for owners of Chihuahuas (remember "Yo quiero Taco Bell"?). Here's how I would check to see if there are enough customers: 1. Search Google Trends for the term "chihuahua" and other similar words (e.g. poodle, dogs) for comparison:  (Click image to expand) We can see that the word "chihuahua" has a decent search volume (relative to "dogs"), and that "poodle" isn't as popular. It also looks like the number of searches for "chihuahua" has been relatively stable for the last few years.

Google Insights is great, because it breaks down the search data by location (i.e. what regions the searches are coming from), by date, and what they're searching for (news, images, products). Click here to see the full report for the above chart. 3. Look at the total number of people available on Facebook for dogs: 3.1 million. Not bad, not bad. And for Chihuahuas: 84,260 people. Score. You can also see if there is a large property that you can piggyback on. Paypal did this with eBay, AirBnb is doing it with Craigslist home listings, and AppSumo looks to the 100 million LinkedIn users. If you can find a comparable site with a large number of potential customers, you'll be in good shape. What helped me with finding $1,000,000 worth of customers for AppSumo was studying my successful competitors; specifically, Macheist. Their site did a Mac-only deal that generated more than $800,000. Macheist shares their sales revenue publicly, but you can use your own business acumen on the CrunchBase list to see which business you want to replicate. For instance, you might research Airbnb.com, discover that they have a profitable and growing marketplace, then decide to create a similar service for alternative verticals. I like to create a Google Spreadsheet of the key numbers for my competitors' businesses. Below is an example of what that might look like for Macheist in their Mac bundles. [Warning to the haters: This may not be accurate, but I used these numbers just to get a rough idea of the business' potential.]

Step 3: Assess your customer's value. Once you've found your idea and a big pool of potential customers, you'll need to calculate the value of those customers. For our example above, we'll need to estimate how much a Chihuahua owner (i.e. our customer) is worth to us. This will help us determine the likelihood of them actually buying our product, and will also help with pricing. Here's how we do that: 1. Find out how much it costs, on average, to buy a Chihuahua ( about $650). This is the base cost. 2. See how much it costs to maintain a Chihuahua each year (i.e. recurring costs). Looks like it's between $500-3,000. For this example, we'll call it $1,000. 3. Look up their life expectancy, which is roughly 15 years. This is the number of times they'll have to pay those recurring costs. Therefore, a Chihuahua's average total cost of ownership is: [$650 + ($1,000*15)] = $15,650 Damn… you could buy a lot of burritos with that kind of cash. Silly dog owners. In any case, these owners are already committing to spend a LOT of money on their dogs (i.e. they are valuable). After putting down $650 on the dog itself and an average of $80/month on maintenance (a.k.a. food), spending $50 on an information product that could help them train their Chihuahua–or save money, or create a better relationship between them, etc.–does not seem unreasonable. Of course, the product doesn't have to cost $50, but we now have some perspective for later deciding on a price. Now we need to utilize the TAM formula (a.k.a. Total Available Market formula), which will help us see our product's potential to generate a million dollars. Here's the TAM formula for estimating your idea's potential: (Number of available customers) x (Value of each customer) = TAM

If TAM > $1,000,000, then you can start your business. Let's plug in some basic numbers to see the TAM for our Chihuahua information product: (84,260 available customers) x ($50 information product) = $4,213,000 We have a winner! Okay, obviously you are not going to reach 100% market penetration, but consider the following… 1. This is only through Facebook traffic. 2. This does not include the 5,000,000 monthly searches for "Chihuahua" on Google:

3. This is only for one breed of dog. If you find success with Chihuahuas, you can easily repeat the process many times with other dog breeds. 4. This is only for one product. It's far easier to sell to an existing customer than it is to acquire new ones, so once we've built up a decent customer base, we can make even more products to sell to them. By all measures, it appears that we have a million dollar idea on our hands. Now we can move on to the final step! Step 4: Validate your idea. By now, you have successfully verified that your idea has that special million-dollar-potential. Feels good, right? Well, brace yourself — it's time to test whether people will actually spend money on your product. In other words, is it truly commercially viable? This step is critical. A lot of your ideas will seem great in theory, but you'll never know if they're going to work until you actually test your target market's willingness to pay. For instance, I believed AppSumo's model would work just on gut-feeling alone, but I wasn't 100% convinced people wanted to buy digital goods on a time-limited basis. I mean, how often do people find themselves needing a productivity tool (compared with, for instance, how often they need to eat)? I decided to validate AppSumo's model by finding a guaranteed product I could sell, one with its own traffic source (i.e. customers). Because I'm a frequent Redditor and I knew they had an affordable advertising system (in addition to 3 million+ monthly users), I wanted to find a digital good that I could advertise on their site. I noticed Imgur.com was the most popular tool on Reddit for sharing images, and they offered a paid pro account option ($25/year). It was the perfect fit for my test run. I cold-emailed the founder of Imgur, Alan Schaaf, and said that I wanted to bring him paying customers and would pay Imgur for each one. Alan is a great guy, and the idea of getting paid to receive more customers was not a tough sell :) The stage was set! Before we started the ad campaign, I set a personal validation goal for 100 sales, which would encourage me to keep going or figure out what was wrong with our model. I decided on "100″ after looking at my time value of money. If I could arrange a deal in two hours (find, secure, and launch), I wanted to have a return of at least $300 for those two hours of work. 100 sales ($3 commission per sale) was that amount. By the end of the campaign, we had sold more than 200 Imgur pro accounts. AppSumo.com was born. I share this story because it illustrates an important point: You need to make small calculated bets on your ideas in order to validate them. Validation is absolutely essential for saving time and money, which will ultimately allow you to test as many of your ideas as possible. Here are a couple methods for rapidly validating whether people will buy your product or not: Drive traffic to a basic sales page. This is the method Tim advocates in The 4-Hour Workweek. All you need to do is set up a sales page using Unbounce or WordPress, create a few ads to run on Google and/or Facebook, then evaluate your conversion rate for ad-clicks and collecting email addresses. This is how we launched Mint.com (see one of our original sales pages here). You are not looking for people to buy; you are simply gauging interest and gathering data. [Note: With Facebook advertising, $100 can get you roughly 100,000 people viewing your ad, and about 80 people visiting your site and potentially giving you their email addresses.] Email 10 people you know who would want your pseudo-product, then ask them to send payment via Paypal. This might sound a bit crazy, but you're doing it to see what the overall response is like. If a few of them send payment, great! You now have validation and can build the product (or you can refund your friends and buy them all tacos for playing along). If they don't bite, figure out why they don't want your product. Again, the goal is to get validation for your product, not to rip off your friends. Of course, there are other techniques for validating your product (like Stephen Key leaving his guitar pick designs in a convenience store to see if people would try to buy them). However, I've found these two methods to be super efficient and effective for validating ideas online. No need to get fancy if it does the trick. The Final Frontier: Killing Your Inner Wantrepreneur We made it! You officially have a $1,000,000 idea on your hands and you know for a fact that people are willing to pay for it. Now you can get started on actually building the product, creating your business, and freeing yourself from the rat race! I can just see it… You're all nodding and thinking, "Hey, this Noah guy is pretty snazzy!" (Sorry ladies, I'm taken.) So, what now? - You are inspired. Check.

- You want to do something. Check.

- You get a link to a funny YouTube video, then you open up Reddit. Check.

- Suddenly, everything you thought you were going to do goes down the drain. Check.

- You and I softly weep. Check. I want to challenge you! Whoever generates the most profit (not just revenue) within 14 days of this article will win some fantastic goodies. First, here are the basic rules and the process: - Contest void where prohibited.

- The business/product must be new. This means either a landing page created from scratch using Unbounce or WordPress above, or via the latest Shopify competition (not too late to sign up). If from Shopify, it will be your *increase* in profit over the next 14 days vs. the prior 14 days, not the *total* profit of 14 days.

- Results and proof of some type must be submitted as a comment below no later than 1am PST Saturday on October 8, 2011. Don't cut it too close; if a timezone misjudgment knocks you out, we can't make exceptions.

- Put your 14-day profit number (or increase) in the FIRST line of your comment.

- Ultimately, verifiable proof with lower number beats unverifiable proof with higher number. The prizes: - $1,000 credit from AppSumo.com

- Roundtrip flights to Austin, Texas to have the most delicious tacos in the world with Noah Kagan, CEO of AppSumo. Sorry, but we can only cover flights within the USA. If you want to hoof it to the US, we can then pick up from there.

- Above all: your $1,000,000 business, of course! Don't let this post become another feather in your Wantrepreneurship cap. Just follow the steps and start working towards your $1,000,000 business! Remember, you can start laying the foundation for your product without building anything. All you need is one weekend. From: The Blog of Author Tim Ferriss

Peace & financial prosperity,

Seko & Rhonda VArner [Established 09/20/1997 RCC] If you know of anyone looking to Buy, Sell, or Refinance a home. Please call us ! If you know anyone who is having problems with debt, wants to invest for great returns, or needs financial protection, we are they for them ! TEAM VARNER'S Financial FREEdom Seko VArner, World Financial Group 15PNZ Your trusted agents, your favorite DJ.

rhoseko@yahoo.com

Cell/Office: 757-248-3820 Fax: 866-400-0201 |